The Council of Ministers recently issued an amendment (106/2024) (“Amendment”) to the Companies Law (1/2016) (“Companies Law”) with respect to the quorum and majority requirements of limited liability companies’ Extraordinary General Meetings (“EGM”). The Amendment could have significant effects on current business practices in Kuwait, and specifically on foreign shareholders in Kuwait.

What is an EGM?

An EGM is a general partners meeting that enables partners to pass significant decisions with respect to a company’s operations and dealings. Examples of such decisions include:

(1) Amending the company’s articles of incorporation;

(2) Resolving to merge, transform or spin-off the company;

(3) Increasing or decreasing the company’s capital;

(4) Dismissing or changing the company’s manager, or otherwise limiting his authorities, only if the manager is specified by name in the company’s articles of incorporation; or

(5) Dissolving the company.

The competency of an EGM vis-à-vis a limited liability company’s operations and constitution is much higher than that of an Ordinary General Meeting (“OGM”), which is somewhat limited to ratifying business and financial reports and passing other ordinary decisions relating to the company’s operations.

Status Quo Before the Amendment

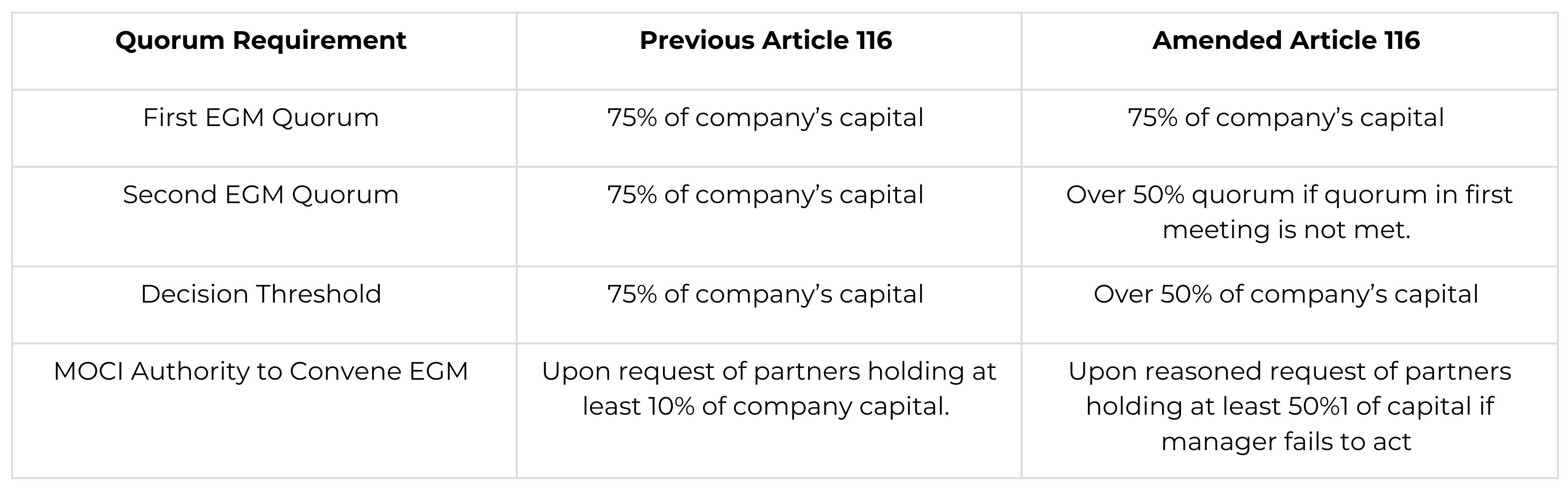

Prior to the Amendment, the Companies Law’s provision with respect to EGMs, Article 116, required that an EGM could only be valid if partners representing at least three-quarters (75%) of the company’s capital were present. Furthermore, resolutions could only be passed with the approval of partners holding at least three-quarters (75%) of the company’s capital.

This higher threshold often created both advantages and challenges for convening EGMs and passing resolutions.

On the positive side, requiring the attendance and approval of partners holding at least three-quarters (75%) of the company’s capital ensured that major decisions reflected a strong majority consensus. This high threshold acted as a safeguard against unilateral decision-making by a small group of partners, protecting the interests of minority shareholders. It provided stability in governance and prevented contentious or hasty decisions that might harm the company’s long-term viability.

However, the drawbacks of such a stringent requirement became apparent in practice. The high quorum and majority threshold often created significant challenges in convening EGMs and passing resolutions, particularly in cases where achieving the required attendance or agreement among partners was difficult. Companies frequently faced delays in decision-making, as failing to meet the quorum meant that critical decisions could not be addressed, even in urgent situations. This was especially problematic for companies with fragmented ownership structures or absentee partners, such as those with foreign partners who may not be readily available to participate in meetings.

Additionally, this structure sometimes led to deadlocks, where a minority of partners holding just over 25% of the capital could block resolutions, effectively stalling the company’s ability to respond to pressing operational or strategic needs. For example, efforts to remove a non-performing manager or approve necessary capital increases could be thwarted by a small minority, even if the majority supported the change.

Post-Amendment

1- Quorum

In light of the Amendment, while the quorum for the first EGM remains unchanged (requiring the attendance of partners owning at least 75% of the company capital), the Amendment now introduces the possibility whereby in the event the quorum (at least 75%) is not met in the first EGM, a second EGM can be convened whereby a lower quorum is required: the attendance of partners owning more than half (50%+1) of the company’s capital. This adjustment provides the possibility of a second EGM with a lower quorum.

2- Majority Threshold

Another pivotal change introduced by the Amendment is the lowering of the decision-making threshold. Previously, EGM resolutions required the approval of partners holding at least 75% of the capital, making it difficult to pass resolutions even when the majority of partners were in agreement. Under the new rules, EGM resolutions can now be passed with a majority exceeding 50% of the company’s total capital, regardless of whether the meeting is the first or second EGM.

Ministry of Commerce and Industry (“MOCI”) Involvement

Further, the Amendment increased the minimum capital ownership required by the partners to not less than half of the company capital (50% or more) should the partners wish for the MOCI to call for an EGM in the event the manager of the company fails to do so.

Prior to the Amendment, partners owning at least 10% of the company capital were required for the manager to convene an EGM. Partners owning not less than 10% of the company capital would request for the MOCI to convene the EGM should the manager fail to do so.

Pursuant to the Amendment, the percentage increased from 10% to 50% of capital ownership by the partners. Should the manager fail to convene an EGM, partners owning at least 50% can submit a reasoned request to MOCI for the latter to convene the EGM.

The MOCI shall invite the partners to convene an EGM upon the submission of a reasoned request by the partners representing at least half of the company’s capital.

Our Thoughts

The amendment reducing the quorum to more than 50% in the second EGM increases the chances of convening EGMs and this may be helpful in cases where a resolution is needed for the viability of a company, i.e., where partners wish to remove a poorly performing manager who was appointed in the company contract but were not able to remove him due to failure in obtaining a 75% quorum and majority requirement.

By reducing the majority threshold to more than 50%, the chances of issuing EGM resolutions have increased.

However, as the majority threshold was reduced to more than 50% instead of 75%, local partners have the upper hand in WLL structures given the 49% ceiling for foreign ownership of Kuwaiti companies under the Commercial Code. In such cases, the local partner can obtain resolutions without the need for the foreign partner’s attendance or vote. This dynamic shifts the balance of power in favor of local partners, leaving foreign partners at a disadvantage.

To address this concern, it may be possible to amend the majority threshold in the company contract pursuant to Article 113 and 115 of the Companies Law whereby a higher majority threshold for passing resolutions of EGMs can be included in the company contract.

It is notable to point out that even though the Companies Law stipulates such option, we may face some hurdles with MOCI when implementing it due to MOCI’s online portal not offering all options stipulated in the Companies Law.

In summary, while the Amendment facilitates more efficient governance and decision-making, careful structuring of partnership agreements is essential to balance the interests of all parties.

On 31 March 2025, Decision No. (3) of 2025 issued on 20 January 2025 by the United Arab Emirates (“UAE”) Cabinet of Ministers (the “Decision”) came into effect. The Decision supplements Federal Decree-Law No. (36) of 2023 on the regulation of competition (the “Competition Law”) and establishes specific thresholds that… Read more

The Kuwait Constitutional Court on 5 February 2025, ruled that Paragraph 1 of Article 34 of the Competition Protection Agency Law No. 72 of 2020 (the "Law") is unconstitutional. This judgment has far-reaching implications for competition enforcement in Kuwait, particularly regarding financial penalties imposed by the Competition Protection Agency ("CPA").… Read more

The Council of Ministers recently issued an amendment (106/2024) (“Amendment”) to the Companies Law (1/2016) (“Companies Law”) with respect to the quorum and majority requirements of limited liability companies’ Extraordinary General Meetings (“EGM”). The Amendment could have significant effects on current business practices in Kuwait, and specifically on foreign shareholders… Read more

London and Kuwait City – A team of Meysan lawyers served as legal counsel to a Kuwait-based consortium of shareholders, including Fahad Ali AlGhanim, Hamad Abdulmohsen AlMarzouq, Kamil G. Karam, and Meshal AlMarzouq, on the acquisition of Milton Keynes Dons Football Club (MK Dons), including the football club, Sports and Education Trust,… Read more

We are proud to have acted as legal counsel to the Lead Manager and Subscription Agent Kuwait Financial Centre (Markaz) in relation to the successful issuance by Commercial Bank of Kuwait (Al-Tijari) of the Second Tranche of Basel III compliant Tier 2 Bonds with value of KWD 50 million and… Read more